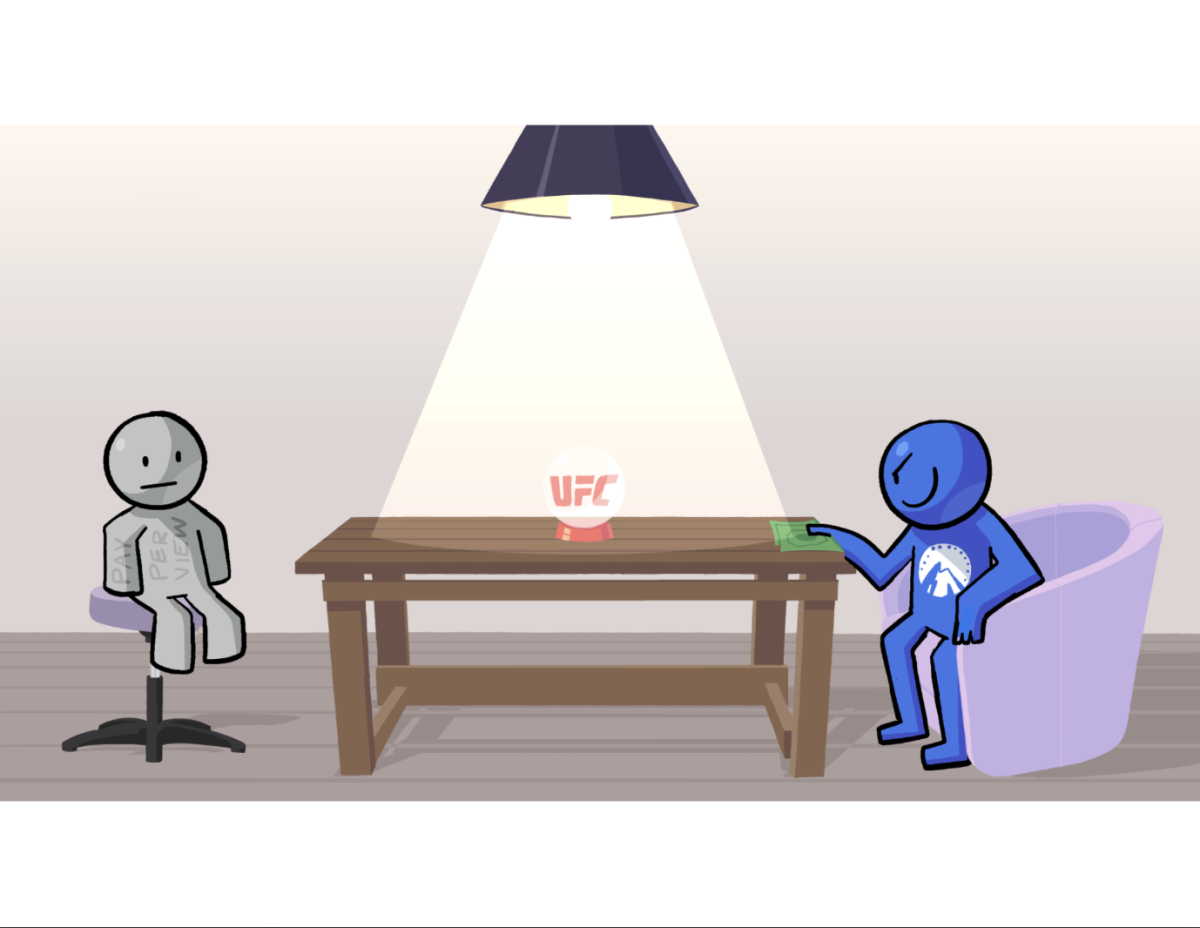

On May 1, the Student Investment Fund (SIF) presented its performance this year to the Investment Committee of the Board of Trustees. The presentation covered a performance update, overviews of equities and fixed income and recommendations for the $1.2 million portion of the endowment they manage.

The SIF, an extension of the investment club, organizes weekly meetings with AP Economics teacher Brian Held ‘93 and Board Member Zachary Levenick ‘96. Learning economic and financial concepts from the two, SIF uses their knowledge to compete against other schools in stock pitch competitions.

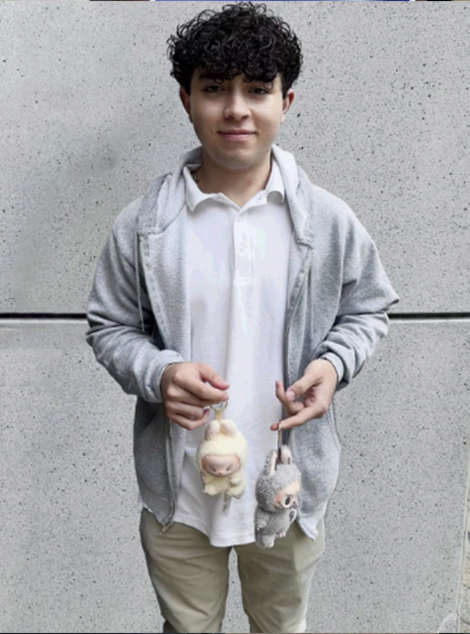

As Diego Pa-Ortiz ’26 described, “The Student Investment Fund is a student-driven, teacher-moderated group that manages a portion of Loyola High School’s endowment. We analyze stocks, keep track of current events and invest to grow Loyola’s endowment for the future.”

Prior to the annual Board presentation, SIF recruited a group of active students in the investment club to join the Student Investment Fund next year. These top-notch students were evaluated and selected at an in-house stock pitch competition, where teams presented their stock and described its competitive advantage to a judging panel. After attending an introductory meeting, the future members were invited to observe the annual board presentation.

Jack Horan ’26, a new recruit, stated, “It’s definitely a long pipeline, but standing out gives you a really cool opportunity to manage real money.”

During the meeting, SIF covered the geopolitical climate–including Trump’s tariff policies and federal rate cuts—as well as the

performance of the broader economy to inform their recommendations to the board.

Having a thorough understanding of current events can be as important as knowing the stocks themselves, as SIF member Riley

Durkin ’25 remarked, “We made sure to meticulously analyze pressing political and economic developments so that SIF’s predictions could be as accurate as possible.” These developments often interact with the portfolio’s performance. One of SIF’s major assets is its stake in Canadian Pacific Kansas City, a railway company boasting a unique rail network.

The trade company was uniquely affected by Trump’s tariff campaign against Canada and Mexico, causing dips in the stock value. However, members of SIF continue to believe in its success.

“Despite some tariffs, the geopolitical trade war with China means trade between Canada, Mexico and the United States will increase, and Canadian Pacific will benefit,” SIF member Rishad Vaghaiwalla ‘26 explained.

Ending its junior year, the SIF continues to spearhead its original objective: giving eager students hands-on experience with investing and benefiting the broader Loyola community.

“Our goal as SIF is to grow our portion of the endowment over time, and we have had success in doing that so far. The result is that the money we earn goes back to Loyola students—it funds financial aid to make Loyola more accessible to anyone who wants to attend,” Pa-Ortiz explained.